How Much Are Chargebacks Costing You?

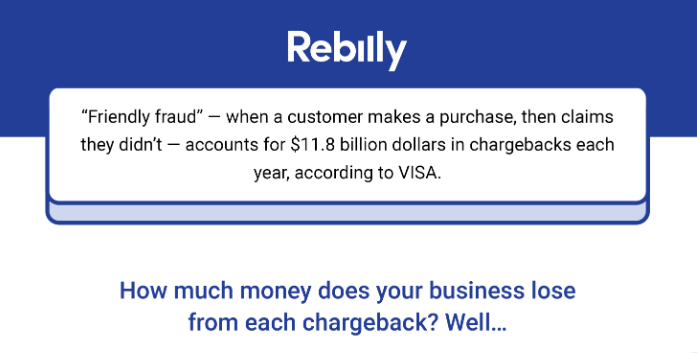

When a customer successfully disputes a charge you’ve made against their credit or debit card, the card issuer will rescind the sale from you – and adds feed on top of it. This process is called a chargeback, and it costs businesses a fortune every year.

Short of physically swiping every subscriber’s card, every month, it can be very difficult to prove that a charge is legitimate. That puts the word of your credit card issuer’s customer against yours, and the customer usually wins.

It’s not just the money that’s at stake, either. In a higher risk business, it’s already hard enough to get new merchant accounts with reasonable rates and terms. Accrue too many chargebacks, and you can find yourself with a termination notice, leaving you without a merchant account altogether.

Let’s look at the full cost of chargebacks for subscription businesses

If you’re looking for more tips to keep your chargebacks under control, head to this post. Or, you can download our Reducing Chargebacks Guide, with our four top actionable tips on how to minimize your losses: