Rebilly KYC

Block fraudsters.

Powerful KYC & AML to block fraudsters and convert real users

Streamline KYC & AML compliance with one-stop-shop identity verification and ongoing risk screening. Powered by AI, built for teams, centered on customers.

$10B+

Approved transactions

199+

Supported gateways

Finally, AML compliance without the speed bumps

Traditional approaches to AML (Anti-Money Laundering) and CFT (Counter Financing of Terrorism) eat away time, money, and most importantly, user satisfaction.

We've combined AI, data science and seasoned payments industry experience to create a Know-Your-Customer "KYC" process both your users and team will love.

Integrate KYC process

ID & document verification

Watchlists, sanctions & PEPs lists monitoring

PCI DSS

Streamline onboarding and slash abandonment rates with automated ID and document checks.

Protect your business

Safeguard against identity fraud, account takeovers, noncompliance penalties and lost revenue.

Save precious person-hours

Automate time-sapping manual ID checks and reduce false positives to free your team's time, energy and resources.

Meet compliance obligations

Our software is continually updated to meet increasingly demanding Anti Money Laundering, Know Your Customer, GDPR and other mandates.

How it works

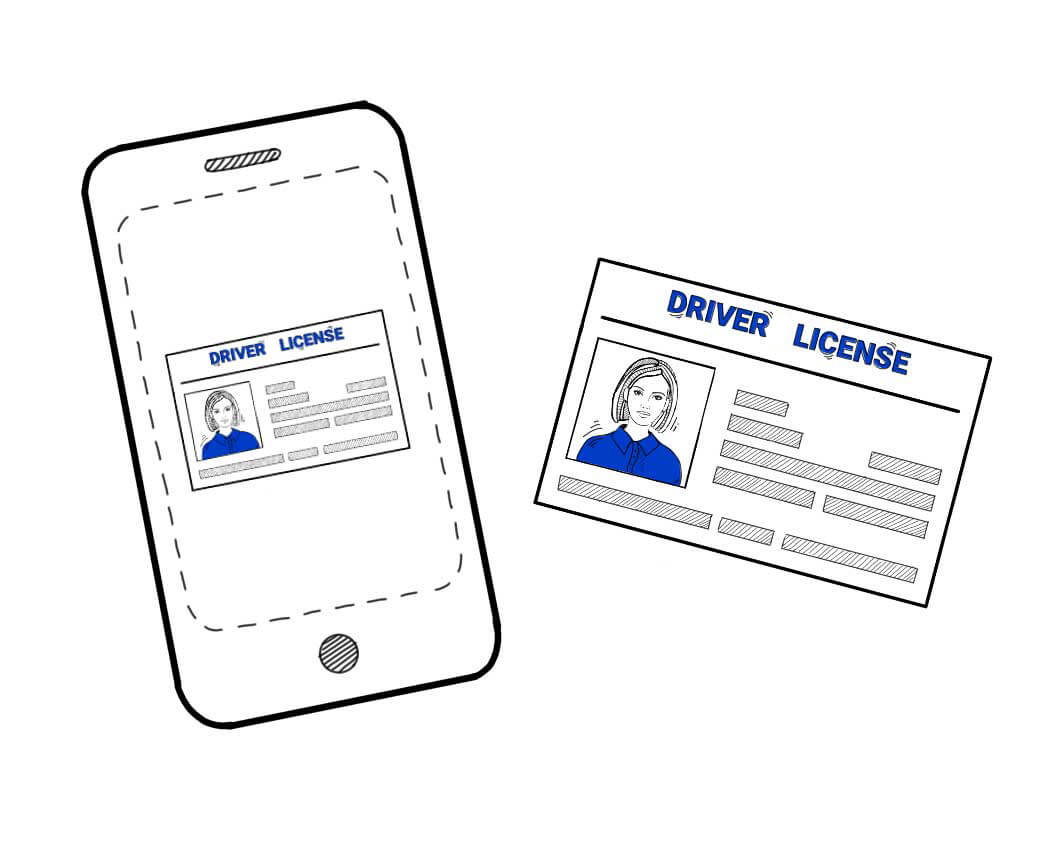

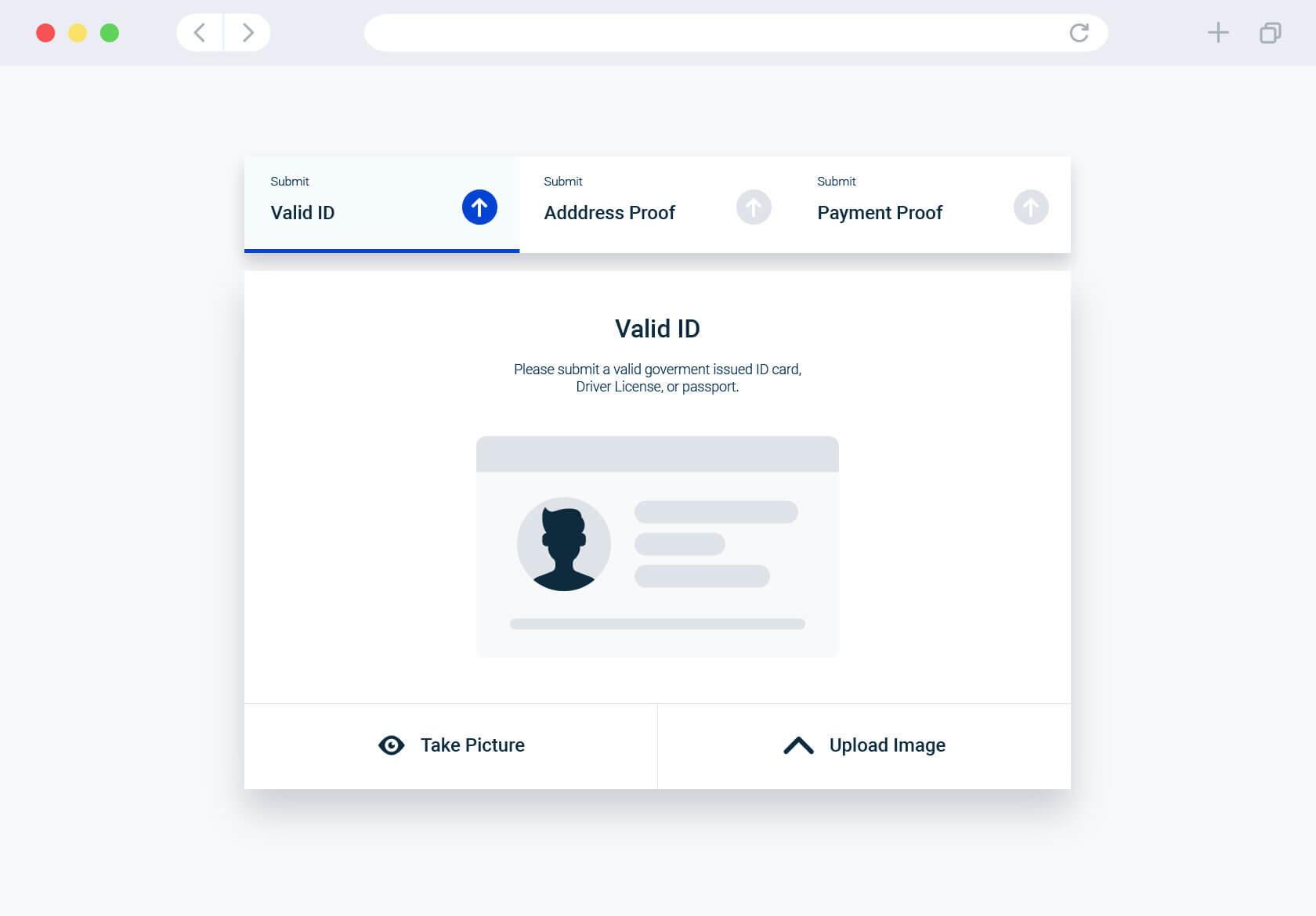

Users easily scan or upload IDs, proof of address, or other documents.

Documents are instantly authenticated by powerful AI technology.

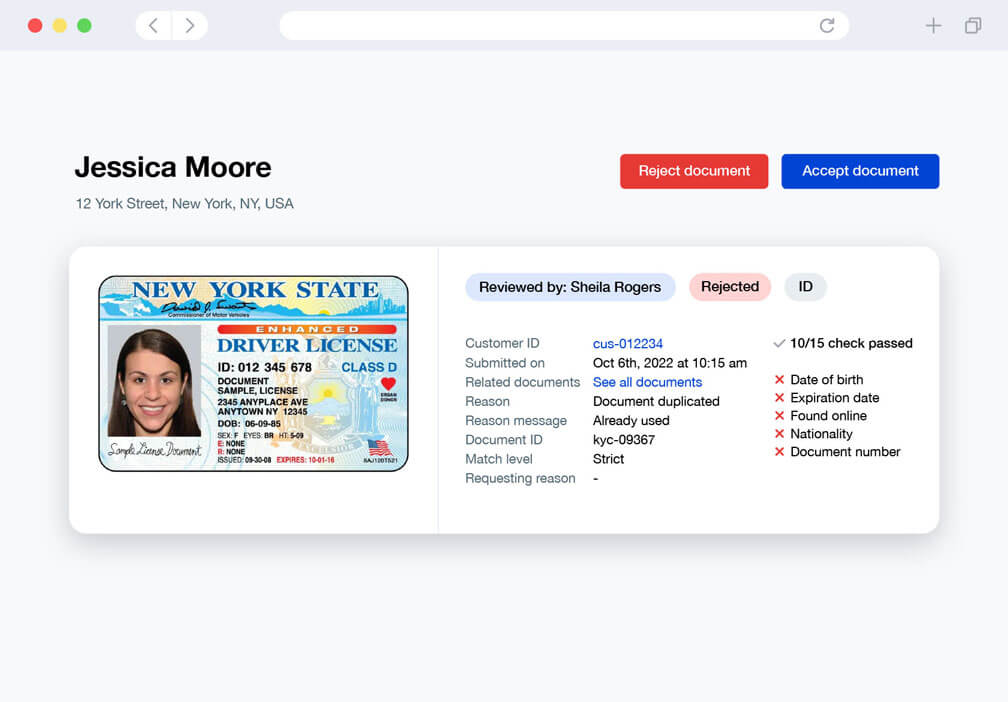

When uncertain, your compliance team can manually accept or reject documents from a single dashboard.

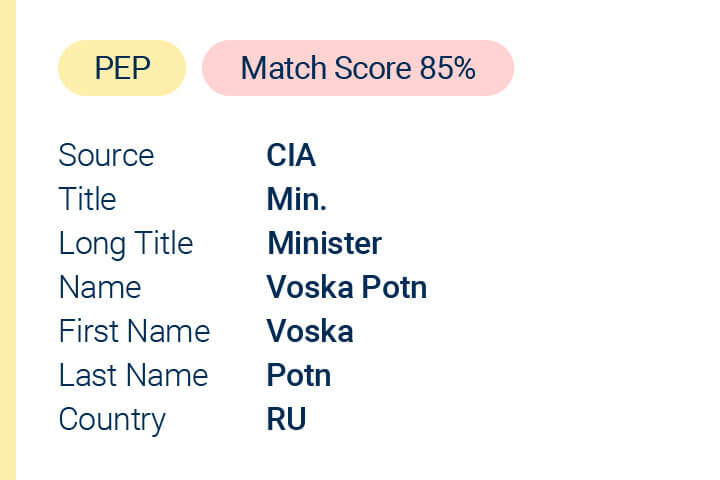

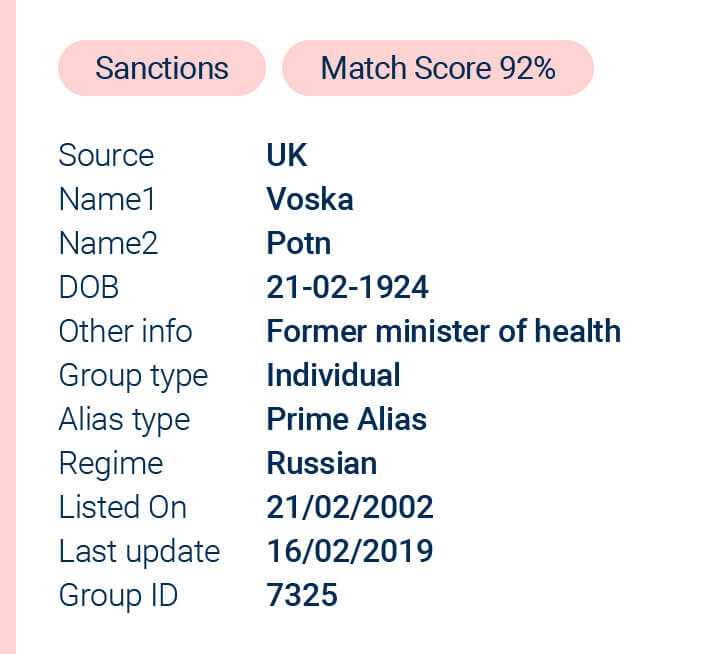

User information is continually monitored against global Sanctions, PEPs and adverse media alerts.

Try out the KYC add-on

Add KYC and AML features to your Rebilly account.

All-in-one solution to empower your compliance team

Automated ID verification

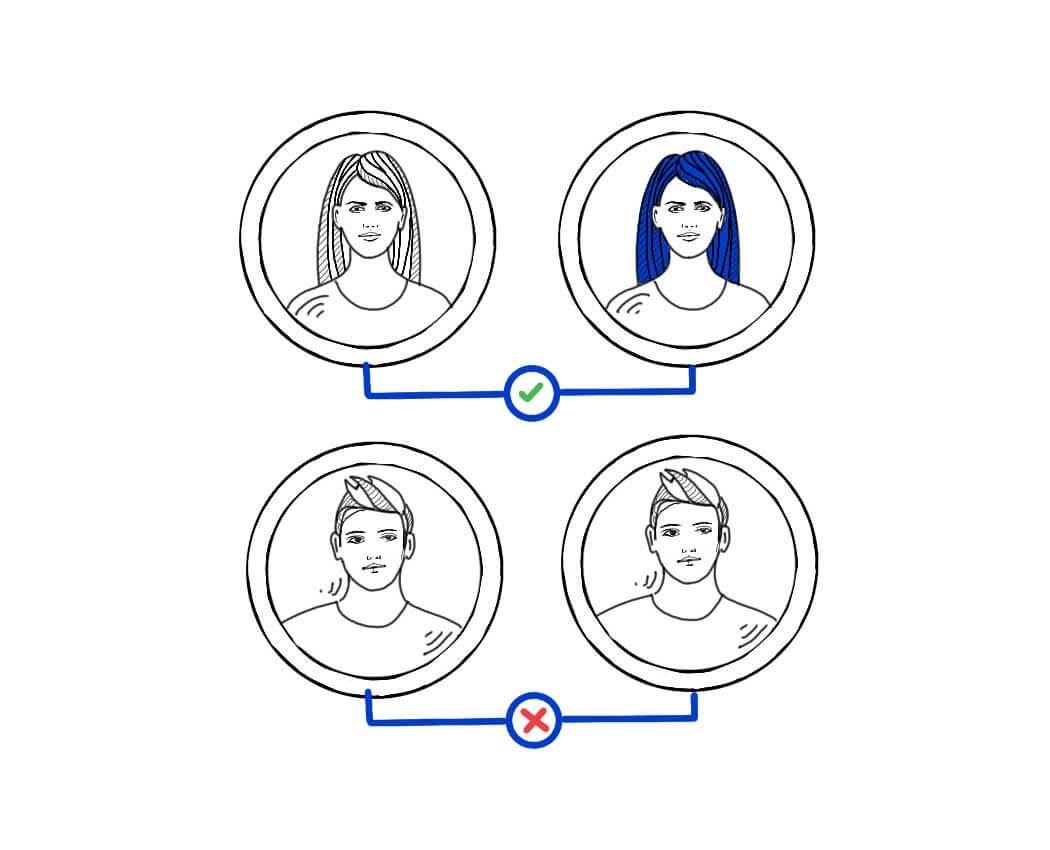

Extract official ID data automatically from uploaded scans or pictures, and instantly determine if it’s real and belongs to the user.

- Instant ID check on mobile and desktop

- Friction-free user onboarding

- Reduced abandonment rates

- Reduce false positives by 80%

- Peak demand approvals

Simplified document checks

Your customers quickly scan documents such as utility bills, credit card statements, and bank statements, and your team saves time verifying information.

- Easily upload and scan multiple documents

- Establish proof of address

- Compare details with information on file

Round-the-clock risk monitoring

Make the right AML risk decisions with global coverage of sanctions, watchlist alerts, and Politically Exposed Persons (PEPs) data, updated regularly.

- Screen customers against global watchlists

- Monitor risk status in real time

- Identify new possible threats

- Ready for EU-5AMLD

Tailored to your workflow

Effortless integration via API or on-premise deployment to your data centers.

Verification and reporting in a single dashboard.

Full integration with Rebilly automations. Try Rebilly

Banking & fintech

Insurance

Lending

Investment

Crypto

Wallets & payments

Shared economy

Gaming & gambling

High-risk corporates

Make compliance a breeze

Streamline KYC and AML compliance with a one-stop solution designed for user experience.