Customer Stories

XY Labs

They’re connecting the physical world with the digital. And we’re connecting their payments & data in service of that mission.

The payments landscape hasn’t been kind to crypto and blockchain innovators. Many payment processors refuse to serve the space, and those that do often lack the advanced engineering, data, and reporting capabilities that these innovators sorely need.

Fortunately, there’s a thing called payments orchestration that helps with this. And who better to chat with about data and… orchestration than the fantastic Christine Sako? She’s Head of Internal Operations and BI at at XY Labs, a trained mathematician, and quite the awesome songwriter (orchestration, get it?).

XY Labs is a multi-product innovation powerhouse with multiple revenue streams – from shipping IoT devices, to subscriptions, to community payouts in crypto. As such, they needed a unified, rock-solid infrastructure of payments and compliance that the providers they were using simply could not offer. Under Christine’s watchful eye, XY Labs integrated with Rebilly in just two weeks, unlocking a host of benefits in one fell swoop:

- Multi-processor checkout fully supporting crypto

- Subscription billing with robust custom data, KPIs, and automations

- Powerful KYC loved by end-users

- All user and payment data in one app, rather than four different dashboards

Here’s how this story went.

Background

Merging the physical and digital worlds with IoT and blockchain

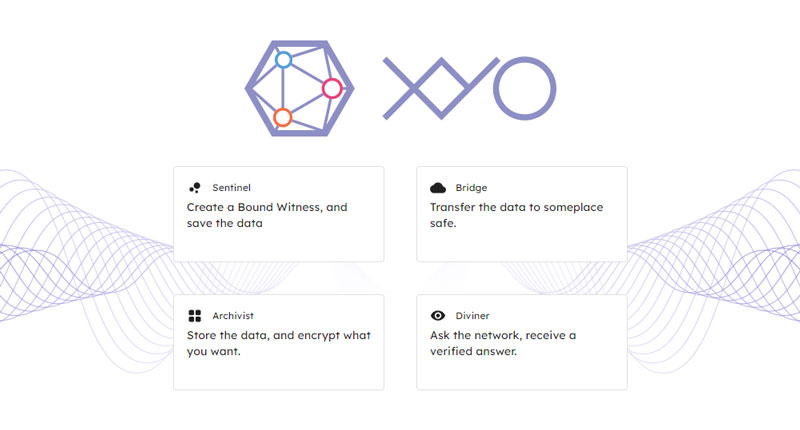

XY Labs was founded in 2012, the same year as Rebilly. They are on a bold mission to connect the real world to the digital one while putting geolocation data in the hands of people. To that end, they have built an impressive product suite that includes:

- XYO Network, an open-source blockchain of Internet of Things (IoT) devices that anonymously collect and validate geospatial data

- The COIN app, which enables over 3 million users to be rewarded for validating the network – and have fun doing it

- A number of IoT products that collect location data and help end-users find their lost items

If you’re not familiar, IoT devices are the billions of physical objects that are connected to the internet around the world. Everything from your airpods to an airplane: if it connects to the internet, it is a part of the IoT. And even if you don’t know anything about IoT, you can appreciate the complexity of (a) an open-source network, (b) with rewards app, (c) connected to IoT data (d) and based on a blockchain.

Feeling dizzy yet?

The challenge

Humble beginnings: connecting niche processors and hoping they stick

XY Labs’ business model has many moving parts, including:

- Subscriptions to their platform

- Payouts to users’ wallets

- Affiliate and referral marketing

- Multiple gateways to accept payments in over 100 countries

- Stringent KYC/AML requirements

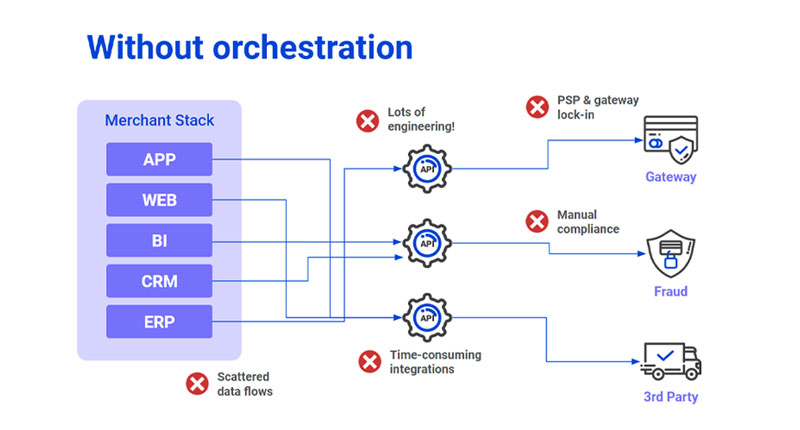

Prior to using Rebilly XY Labs had to connect several solutions to cover all these areas; and they needed these providers to integrate seamlessly to their own platform, blockchain, and business intelligence setup. They also needed as many automations as possible, including for shipping and email notifications, refunds, and much more.

The limitations of ecommerce providers

Before Rebilly, XY Labs were using general-purpose e-commerce providers that didn’t support their desired level of complexity. And on top of that, they needed to use niche processors that specialized in crypto that could not be connected to those platforms:

“We were using out-of-the-box e-commerce solutions and having to plug into whatever payment options were already directly integrated into their system (e.g. WooCommerce, Bigcommerce, Shopify)”

Christine

With such a setup XY Labs not only had limited options to collect payments and subscriptions, but their data was locked inside different tools, which made it hard to understand user behavior, transaction costs, and take action to boost sales and profitability.

Rebilly integration: live in two weeks

Fortunately, a few of the engineers in the XY payments team knew our founder Adam – a well-known “industry dude” as Christine calls him. They gave him a call and both our teams immediately started working on the integration.

With great API docs, direct support over Slack, and a shared passion for payments engineering, Rebilly worked with XY Labs to move quickly and efficiently to make the integration happen. XY Labs had their Rebilly-powered checkout ready just two weeks later. And a few weeks after that, they had completely phased out their previous e-commerce provider.

The solution

Rebilly helps XY achieve flexibility and freedom with their payments

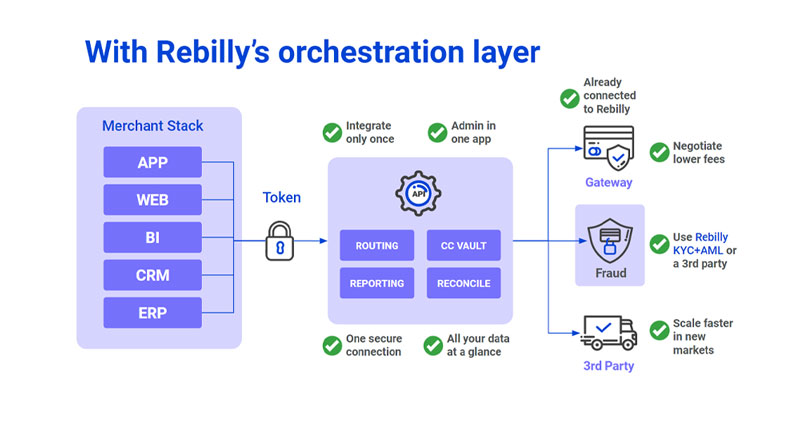

XY Labs uses Rebilly’s entire product suite to manage multiple platforms and processors without needing to “find a needle in a haystack,” while taking full control of their data and offering a fantastic experience to both their end users and developers.

In short, their Rebilly implementation includes:

- Rebilly Payments to connect to multiple gateways around the world and orchestrate payment flows

- Rebilly Billing to manage subscriptions and customer data

- Rebilly KYC add-on for a seamless user onboarding experience

- Rebilly custom fields to collect rich and specific raw data integrated into BigQuery

- Rebilly rules engine that powers automations to reduce costs, errors, and customer service time

- Rebilly data tables and KPI dashboard for tracking exotic metrics

Payments and subscriptions in one place

Rebilly connects XY Labs’ payment gateways in one place and helps them manage and service subscriptions. It has helped Christine and the rest of the team better understand their data and customer journey. The result? More data, to find more opportunities to generate more revenue:

“The flexibility with the development side of things I know has helped us a great deal to be able to partner with a lot of different people that wouldn’t have been possible with a pure [e-commerce platform].”

Christine

XY Labs can now customize how transactions take place, and they’ve even added one-click upsells which is not so easy to do using other software solutions. And their developers appreciate Rebilly’s backend flexibility, which enabled them to automate a large portion of their billing and delivery process with APIs and webhooks:

“The ability to rebill customers on a schedule and gain insights via raw data are both important to us. Also, a flexible API able to hook into other systems that need to be triggered based on events such as billing for a product that needs to be shipped, refunds and subsequent emails so customers are notified, etc.”

Christine

Rebilly’s native billing features alone enable XY Labs to see each customer’s history, improve their sales process, identify suspicious transactions, and fight expensive chargebacks. And custom API automations built on top of that let them expedite their value delivery process, and add new components to their business model at a whim whenever the need arises.

All this, with the peace of mind of having all their data safe, visible and easy to access.

Data & BI built to spec

As Head of Business Intelligence (BI), Christine was supervising the building of XY Labs’ first BI system at the same time that they opted for Rebilly. It was a perfect storm that improved every step of the process.

First, they are able to collect what matters with custom fields, and finally be able to measure a lot of unique metrics that aren’t standard for most industries.

“The flexibility of being able to create custom fields, insert them into our sales process, and do reports based off of that is super powerful; I don’t think it’s something we would have been able to do with Stripe, for example.”

Christine

Christine can then import all this raw data into BigQuery, her data platform of choice, and experiment with custom reports and KPIs as the business evolves:

“Getting all of that raw data has allowed us to do a lot of different types of reporting, and that has been really transformational as far as being able to analyze a lot of the stuff we didn’t have a grasp of before”

Christine

In particular, the ability to visualize data in BigQuery has been instrumental in improving XY Labs’ sales process and conversion. With better data visible at a glance, they were able to identify bugs and issues in their checkout flow, recovering thousands of dollars in what could have been lost revenue had we not been able to immediately pinpoint issues.

Finally, having all data in one place really comes in handy for productivity, peace of mind and plain old sanity:

“You don’t need to log in to like four different platforms to try to figure out where something is.”

Christine

Seamless KYC that users love

With crypto and virtual assets increasingly under scrutiny, KYC/AML is becoming an essential competitive driver in the industry. XY previously relied on a third-party tool that was overpriced, and required users to leave the XY experience to complete their onboarding.

That’s why Rebilly’s KYC add-on was a very welcomed alternative. Using the Rebilly KYC API, the XY team was able to create a completely personalized identity verification flow inside their own app, which increased trust and helped more end-users complete their onboarding without dropping out – or opening new support tickets.

“We now have one platform for all our KYC needs and users can complete onboarding without switching websites, which was confusing and bad for conversion. Plus, it’s great value compared to most providers so we appreciate that!”

Christine

XY Labs’ new KYC/AML process doesn’t only improve the end user’s experience. It also makes it easier for compliance agents to do their job more efficiently. They are able to review and approve documents manually at a moment’s notice from Rebilly’s dedicated dashboard, and focus their energy on providing support to the users who actually need it. Because in the end, this is exactly what a great payments & compliance infrastructure is supposed to do: save professionals time and peace of mind, so they can focus on mission-critical activities.

The outcome

Live in two weeks. Smooth sailing ever since

Payments are the foundation for a business’s peace of mind. When payments, compliance and all related data work just the way they should, awesome teams, such as XY Labs, can focus on what matters most – be it innovating, engineering product, or shaping strategy.

And more importantly, end users can enjoy paying with their favorite methods safely and without disruptions.

Since the initial integration, the team at XY Labs has continued working side by side with Rebilly’s team to experiment, iterate, and optimize their payments. Quarterly business reviews help ensure Rebilly’s roadmap gets ahead of future XY Labs’ needs. And nobody is faster than adding new gateways than Rebilly, enabling them to expand to new markets.

“The familiarity with our customer journey and what we’re doing… the personal relationships and you guys having context, and also having that [direct Slack connection with the team] has been very helpful. It’s been pretty ideal in my opinion.”

Christine

Take it from XY Labs. No matter how complex your payments conundrum, Rebilly is a thoughtful partner with an all-in-one solution flexible enough to deliver what you need.

Ready to free your payments from provider and industry limitations?

XY Labs did it for crypto in two weeks. Learn how Rebilly can help you tailor the perfect payments backbone for your business.