How to Choose Your Subscription Pricing Model

Pricing can make or break a subscription business. Obviously, you can’t just pick a number out of a hat. You need to make sure that you’re pricing in a way that allows for sustainable business growth, while also enticing customers, while also not leaving any money on the table.

Where should you start and what do you need to consider to protect your bottom line? Read on to find out:

Pricing vocabulary: plans, formulas, and more, oh my!

Before we dig in too deep on the subject of pricing itself, let’s lay some groundwork for subscription-specific price terminology. There are a few different terms to know:

- Pricing formula, which is the way in which the price for a subscription is calculated — flat rate, metered, stair-step, etc. (You can read our comprehensive guide to pricing formulas here.)

- Pricing plan, which is the rate that the customer pays, and is created by using one or more pricing formulas to create the final price. For example, you might pay a flat-rate per user each month, but also pay a metered rate based on how many widgets you use every month. That’s two pricing formulas, added together under one pricing plan. A subscription business might have more than one pricing plan, each with a different price and different features. For example, seeing plans that are “bronze/silver/gold” or “good/better/best” is fairly common.

Now that that’s done, let’s move on to one of the biggest components in pricing successfully…

Cost vs. value

At the highest level, there are two big factors that you need to take into account when pricing your subscriptions:

- The value your customer gets from using the product

- The cost involved for you in creating/selling the product

Obviously, you need to make sure that you’re covering your costs…at least, if you want to be in business for very long. At the same time, you need to have some idea of how much your customers value your product, to make sure you aren’t leaving money on the table.

Think about it:

- If you price your product at $200/month because that’s what you think it’s worth, but the average customer doesn’t, then you’re unlikely to have enough customers to sustain your business.

- If you price at $20/month because that covers your costs with a decent profit margin, you could be leaving money on the table if your customers would be willing to pay more.

Figuring out your costs and overhead is usually the simpler part of this problem. If you need some help getting started, here’s a few guides:

- How to Calculate Gross Margin and COGS for Your SaaS Business

- How to Measure Your Business’s Profitability

- How To Find Product Gross Margin

When it comes to trying to pin down a number for the value your customers get from your product, here’s a few tips:

- Talk to your customers (or would-be customers) about the impact it has on their life. Listen to not just the specific words they use to convey that impact, but how far reaching the impact has had — is it lowering their stress levels at work? Making it easy for them to get more work done? Does it free up time to spend with their children?

- For certain products (B2B, or some B2C products if they’re related to finances, etc.), you can actually calculate the ROI for your product, which is an easy way to put a number to the value. If 90% of your clients save $3,000 over six months of using your product…well, there you go!

- Look at industry norms and what your competitors charge (more on that in a minute).

You can also test your prices over time (read more about that here) to make sure that you aren’t leaving money on the table.

Industry norms

You shouldn’t set your prices based solely on what others in the industry are doing — but you do need to at least be aware of it. If most of your competitors are charging $10/month, and you want to charge $50/month, you need to be ready to prove to would-be customers why your product is worth more.

On the flip side, if your competitors are charging $50/month and you’re charging $10/month, you might still need to reassure customers. People may be suspicious of a lower-priced offering — thinking it’s too good to be true or that it means the product is lower quality. Depending on the industry you’re in, customers may be especially suspicious. For example, if it’s a product that’s protecting their business, a lower price may make them feel like their data is less safe.

As you’ll probably notice, this ties back into the value question from the previous section. First time business owners often think that the lower they price their products, the better — after all, who doesn’t want a good deal, right?

The reality is, if a would-be customer considers your service or product high-value, and the pricing is drastically lower than expected (compared to that value), they’ll often interpret that disconnect as a sign that something is amiss. Logical? Absolutely not, but it’s how our brains work.

Want to learn more about the psychology of pricing and how it can impact your sales? Check out these resources:

- One-Time Sale vs. Subscription: What Makes Customers Buy?

- Setting value, not price

- Pricing Psychology guide from Nick Kolenda

- 5 Psychological Studies on Pricing That You Absolutely MUST Read

- The Psychology of Pricing

Ease of explanation

Many subscription companies go with either a fixed fee ($11.99/month for an ad-free Hulu account) or flat rate ($9.99/user/month for Asana Premium). While these pricing formulas might not always be the most profitable, they are among some of the easiest to explain to customers.

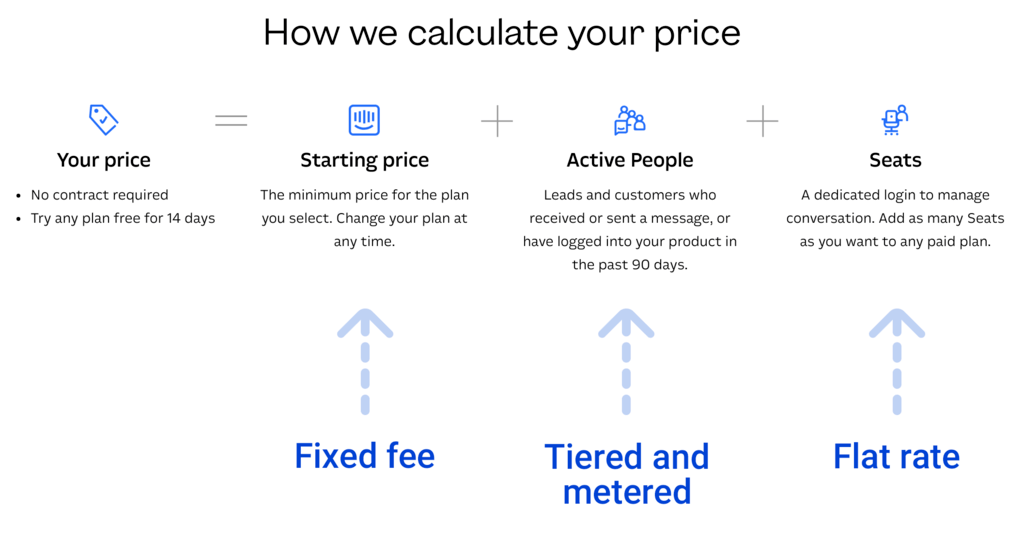

However, if you have a pricing plan that combines several pricing formulas, you need to make sure that it’s as easy to understand as possible. You can see an example of this in Intercom’s pricing, which we discussed in a previous post:

By having pricing plans that involve multiple pricing formulas, Intercom is making the most from every plan and covering all of their costs in the process. At the same time, they need to explain all of the factors that go into the pricing plan, in a way that people can understand quickly. That way, there aren’t any nasty surprises when the customer receives their invoice.

If you’re planning on using pricing that involves multiple formulas, you can use the following techniques to make it as clear as possible:

- Have a pricing calculator on the landing page

- Include visual aids (like the Intercom graphic)

- Have several customer examples and their final price

Pricing plans: How many is too many?

How many pricing plans should you offer? How many billing schedules? More options is always better, right? Not necessarily. In general, companies tend to stick to 3-5 plans, with occasional outliers of only one pricing option. Having less pricing options has an obvious upside: your customers are less likely to get overwhelmed with options or suffer from decision paralysis.

The downside is equally obvious. If customers want features that aren’t available on that plan, then you’ve either lost a customer or you’re leaving money on the table. The customer may sign up for your one available option, but they would have paid you 25% more every month for the additional features they want.

Sometimes, companies take this path early on, and add more plans later. Groove is a notable example of this — they switched to one pricing plan and had a huge jump in conversions afterwards. Several years later, they now offer three pricing options.

On the other hand, offering more plans can sometimes increase conversion, especially when there’s a “decoy” plan (which is essentially created to make the other plans look better). The sweet spot seems to be around three plans, and definitely no more than five.

Don’t forget: The limitations of your billing software

On a purely logistical note, when you’re creating a pricing strategy, make sure that you’re taking billing software into account. Many entry-level subscription billing software tools only allow for flat rate monthly subscriptions, so if you want to charge per user, by volume, or use another pricing formula, you may not be able to. If a certain pricing style makes the most sense for your business and customers, make sure that you’re looking for a subscription billing tool that fits the pricing plan and your business, instead of the other way around.

Now that you’ve got a solid foundation for building your pricing strategy, learn more about how to get the most from every sale.

It’s time to stop leaving money on the table and start optimizing your pricing. Our experiment list makes it easy to begin today: