Dynamic currency conversion

Dynamic Currency Conversion (DCC) provides flexible currency management for transactions, providing either customer choice in payment currency or automated currency conversion. This feature provides a transparent payment experience and supports currency conversion with configurable markup rates.

- DCC is a premium Rebilly feature and comes at an additional cost. Before you use this feature, contact Rebilly.

DCC interactions types

The following table describes all DCC interaction types.

| Type | Customer interaction | Available payment methods | Markup | Description |

|---|---|---|---|---|

| DCC offer | Required | Payment cards only. | Required | The customer is presented with an offer to pay in the currency that is associated with the Bank Identification Number (BIN) of the customer's payment card. The customer can choose to use the currency associated with the BIN of their payment card or the original transaction currency. The offer includes a conversion rate and a specified markup. For more information, see DCC offers. |

| Force conversion | Not required | All payment methods. | Required | The transaction is automatically converted to the specified currency without customer interaction. This option is useful for businesses that want to ensure consistent accounting and manage currency exchange rate fluctuations. For more information, see Forced conversion. |

DCC offers

DCC offers are displayed to customers when the currency of a transaction differs from the currency that is associated with the Bank Identification Number (BIN) of the customer's payment card.

DCC offers are only available for payment card transactions.

The customer can choose to use the currency associated with the BIN of their payment card or the original transaction currency. The offer includes a conversion rate and a specified markup. To configure a DCC offer, see Set up DCC.

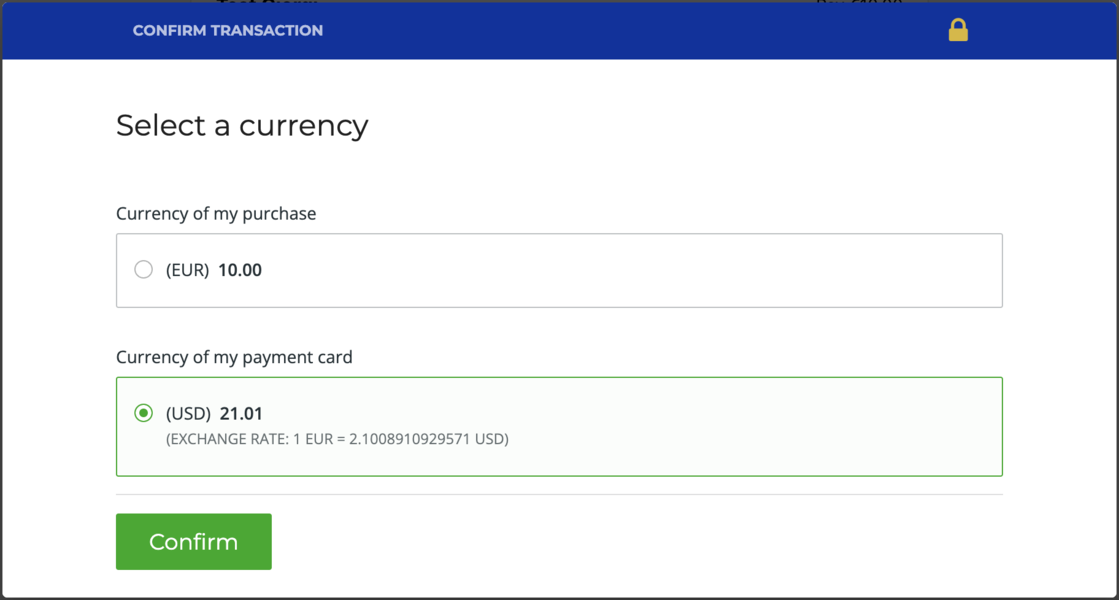

DCC offer example

In this example, the payment currency of the original transaction is EUR, and the Bank Identification Number (BIN) of the customer's payment card is associated with the USD currency. The gateway account is configured to offer DCC in USD, and USD is not in the excluded DCC currencies list. The conversion rate includes a markup of 10000 basis points, which is 100 percent. To configure a DCC offer, see Set up DCC.

DCC offer outcomes and payment flow

DCC uses an offsite payments flow, where the customer is redirected to approval URL where the DCC offer is displayed. The following table describes DCC offer outcomes.

| Outcome | Description |

|---|---|

unknown | DCC offer was made, and the customer has not yet made a selection. |

selected | DCC offer was made, and the customer accepted the DCC offer. |

rejected | DCC offer was made, and the customer declined the DCC offer and choose to use the original transaction currency instead. |

For more information, see the outcome field of the Create a transaction API operation. To configure a DCC offer, see Set up DCC.

Forced conversion

The force conversion option applies the conversion rate and markup automatically to the specified currency without customer interaction. When this option is selected, the customer does not receive a DCC offer. This option is triggered when currency that is associated with the customer's payment method differs from the currency specified in the force conversion dropdown in the DCC configuration.

The force conversion option can be used with any payment method.

Typically, a negative markup value is used with the force conversion option to account for any fees that the customer's bank may charge for currency conversion.

Example use case: Businesses using multiple payment gateways may use the force conversion option to ensure consistent accounting and to manage currency exchange rate fluctuations. This option automatically converts transactions to a specified currency and allows the use of a negative markup to offer a more competitive rate than the customer's bank.

To configure the force conversion option, see Set up DCC.

DCC markup

DCC markup is configured for each gateway account in basis points. Each basis point is 1/100th of a percent. For example, 200 basis points is the same as 2 percent. Available conversion currencies are determined based on the list of currencies that are associated with the gateway account. You can configure currencies that must be excluded from DCC offers. You can also apply negative markup amounts in DCC offers. For example, this may be used to encourage customers who use specific currencies to use your product or service or to account for any fees that the customer's bank may charge for currency conversion.

To view DCC markup reports over a specified period of time, see View DCC markup reports.

Set up DCC

This process describes how to set up DCC on a payment gateway account. DCC detects when a customer attempts to pay in a currency that is not native to their region.

If the gateway account is configured to accept payment cards as a payment method, you can choose to offer the customer the option to pay in their native currency with a small markup, or to automatically convert the transaction to a specified currency without customer interaction.

If the gateway account not is configured to accept payment cards as a payment method, you can automatically convert transactions to the specified currency without customer interaction.

To use this feature, your payment gateway must support the currencies that you want to offer using DCC. If you are experimenting the sandbox environment and do not have a gateway account set up yet, use the TestProcessor gateway account.

In the left navigation bar, press Settings .

In the Configuration section, press Gateway accounts.

In the list of gateway accounts, select a gateway account.

If you are working the sandbox environment and have not set up a gateway account yet, select TestProcessor.In the top right of the page, press Edit gateway account.

In the Accepted currencies section, press in the Select currencies field and add the currencies you want to accept. For example, add USD and EUR.

In the Advanced configuration section, turn on the Advanced configuration toggle.

In the Dynamic currency conversion (DCC) section, select the Activate dynamic currency conversion checkbox.

Depending on which payment method is configured on the gateway account, select one of the following:

Payment card is the payment method

When payment cards are used as a payment method, you can choose to offer the customer the option to pay in their native currency with a small markup, which is called a DCC offer, or to automatically convert the transaction to a specified currency without customer interaction.

Select one of the following:

DCC offer

DCC offers are displayed to customers when the currency of a transaction differs from the currency that is associated with the Bank Identification Number (BIN) of the customer's payment card.

The customer can choose to use the currency associated with the BIN of their payment card or the original transaction currency.

The DCC offer includes a conversion rate and a specified markup. Use DCC offers to increase conversion rates. For more information, see DCC offers.

DCC offers are only available for payment card transactions.

- Select the Display a DCC offer checkbox.

- In the Conversion markup field, enter a value in basis points. A basis point is 1/100th of a percent. For example, 200 basis points is 2 percent. This value is required. You can also enter a negative value.

- Optionally, to exclude specific payment card currencies from DCC offers: In the Exclude currencies dropdown, add the currencies you want to exclude. For example, if you exclude EUR, and a customer's payment card BIN is associated with EUR, they will not receive a DCC offer.

To apply DCC to all payment card currencies that are active on the gateway account, leave this field empty.

Force conversion

The force conversion option automatically converts transactions to a specified currency without customer interaction. This option is useful for businesses that want to ensure consistent accounting and manage currency exchange rate fluctuations. For more information, see Forced conversion.

The force conversion option is available for all payment methods.

- Select Force conversion.

- In the Conversion markup field, enter a value in basis points. A basis point is 1/100th of a percent. For example, 200 basis points is 2 percent. This value is required.

Negative markups may be used with the force conversion option to account for any fees that the customer's bank may charge for currency conversion. - Optionally, to exclude specific payment card currencies from DCC offers: In the Exclude currencies dropdown, add the currencies you want to exclude. For example, if you exclude EUR, and a customer's payment card BIN is associated with EUR, they will not receive a DCC offer.

To apply DCC to all currencies that are active on the gateway account, leave this field empty. - In the Force currency dropdown, select the currency you want to convert all transactions to.

- Optionally, to round the quoted amount to the nearest whole number: Select the Force rounding checkbox.

Payment card is not the payment method

The force conversion option automatically converts transactions to a specified currency without customer interaction. This option is useful for businesses that want to ensure consistent accounting and manage currency exchange rate fluctuations. For more information, see Forced conversion.

The force conversion option is available for all payment methods.

- In the Conversion markup field, enter a value in basis points. A basis point is 1/100th of a percent. For example, 200 basis points is 2 percent. This value is required.

Negative markups may be used with the force conversion option to account for any fees that the customer's bank may charge for currency conversion. - Optionally, to exclude specific payment card currencies from DCC offers: In the Exclude currencies dropdown, add the currencies you want to exclude. For example, if you exclude EUR, and a customer's payment card BIN is associated with EUR, they will not receive a DCC offer.

To apply DCC to all currencies that are active on the gateway account, leave this field empty. - In the Force currency dropdown, select the currency you want to convert all transactions to.

- Optionally, to round the quoted amount to the nearest whole number: Select the Force rounding checkbox.

Optionally, to test your DCC configuration: Save your changes, then see Test DCC configuration.

Test DCC configuration

This process describes how to test DCC configuration using a Rebilly hosted payment form. This example provides the details of a test payment card that is associated with a German bank, so that a DCC offer is made in EUR. For more test payment cards, see Test payment cards and IBANs.

To use this example, you must have a payment gateway account that is configured to accept EUR and USD, and DCC must be active. For more information, see Set up DCC.

- Log in or sign up to Rebilly.

- In the left navigation bar, press Data tables.

- Press Customers, then in the table of customers, press a customer's name.

If you do not have a customer yet: Press Add customer, add the customer's information, and then press Save customer. - In the top right of the page, press .

- Press Collect payment.

- In the Amount field, enter an amount.

- In the Currency field, select a currency for the transaction.

For this example, select USD. - Select Pay with Rebilly hosted payment form.

- Press Submit.

- In the Payment form URL window, press to open the payment form.

- Enter the following payment card information:

- Card number:

5204245250460049 - Expiration date: Any future date.

- CVV: Any three-digit number.

- Card number:

- Press Continue.

- Press Confirm.

A DCC offer window is displayed. You have the option to pay in EUR, which is the currency associated with the customer's payment card.

The EUR amount includes the markup, if a markup has been specified. - Select the EUR option and press Confirm.

- To view the completed transaction in Rebilly, see View transactions.

Alternatively, to view DCC markup reports, see View DCC markup reports.

View DCC transactions

Use this process to view payment transactions where DCC was applied in data tables.

In the left navigation bar, press Data tables, then press Payments.

Press Sales.

In the top right of the page, press Edit columns, then press Select columns.

In the Select columns field, enter

DCC.Select from the following DCC columns:

DCC outcome: Outcome of the DCC offer. For more information, see DCC offer outcomes and payment flow.

DCC base amount: Base amount of the original transaction currency.

DCC base currency: Original transaction currency.

DCC quote amount: Amount of the DCC offer in the currency associated with customer's payment card.

DCC quote currency: Currency of the DCC offer. This is the currency associated with the customer's payment card.

DCC USD markup: Amount of markup that is applied to the conversion rate and translated to USD. For more information, see DCC markup.

Gateway account DCC force currency: Currency to which the gateway account converted DCC transactions.

Gateway account DCC force rounding: Rounding amount the gateway account performs on DCC transactions.

Gateway account DCC markup: Amount of markup that is applied by the gateway account.

Gateway account excluded DCC quote currencies: Currencies that the gateway account excludes from DCC offers.

Has DCC: Specifies if DCC was applied to the transaction. Press Apply. \

To arrange the columns, press Edit columns, then press Arrange columns. Drag the columns to arrange the order, then press Apply.